TUIFLY-VIRTUAL.COM | Free Printable 2290 Form - Download Fillable Irs Form 2290 In Pdf The Latest Version Applicable For 2025 Fill Out The Heavy Highway Vehicle Use Tax Return Online And Print It Out For Free Irs Form 2290 Is Often Used In Truck Tax Heavy Highway Vehicle Use Tax Return Vehicle Taxes Tax Deadline Use Tax Tax Refund Form Tax Payment Form U s Department Of The Treasury Free Tax Filing Tax Return Template U s

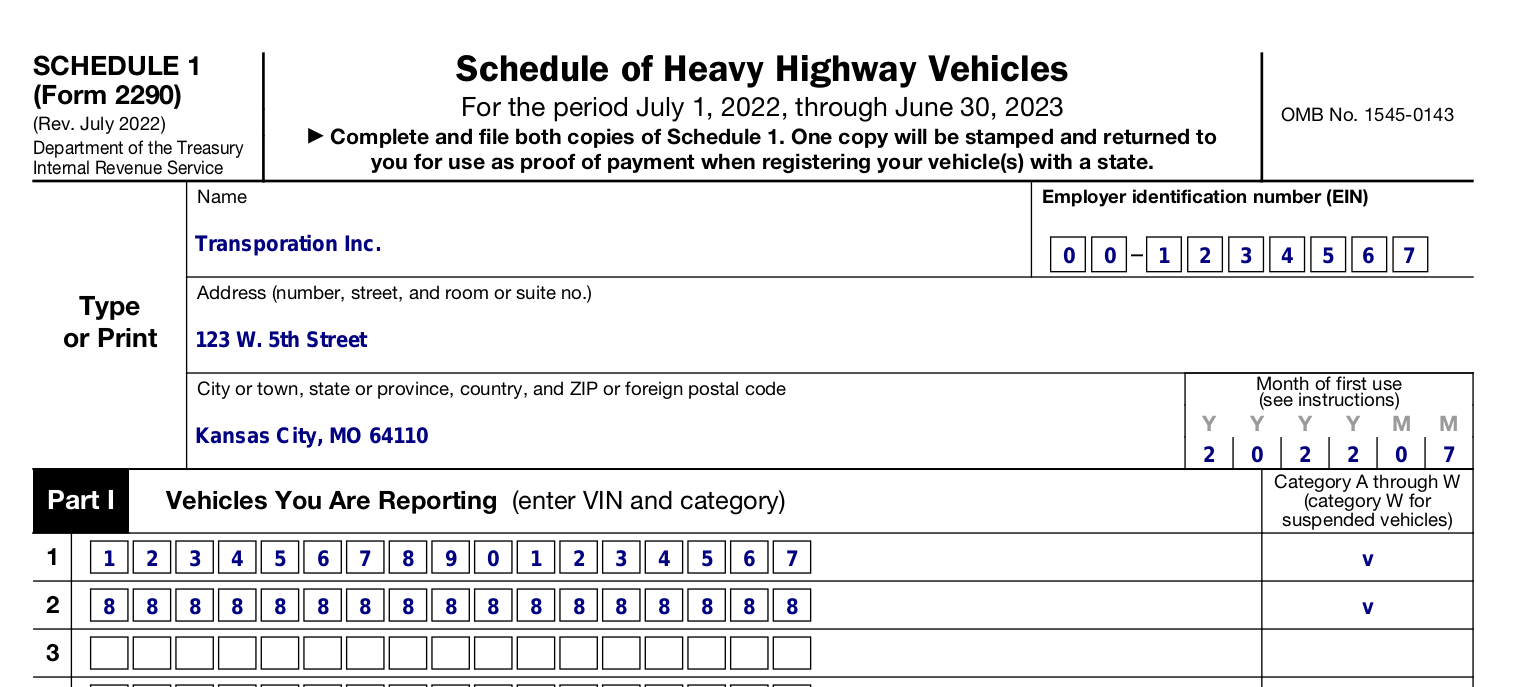

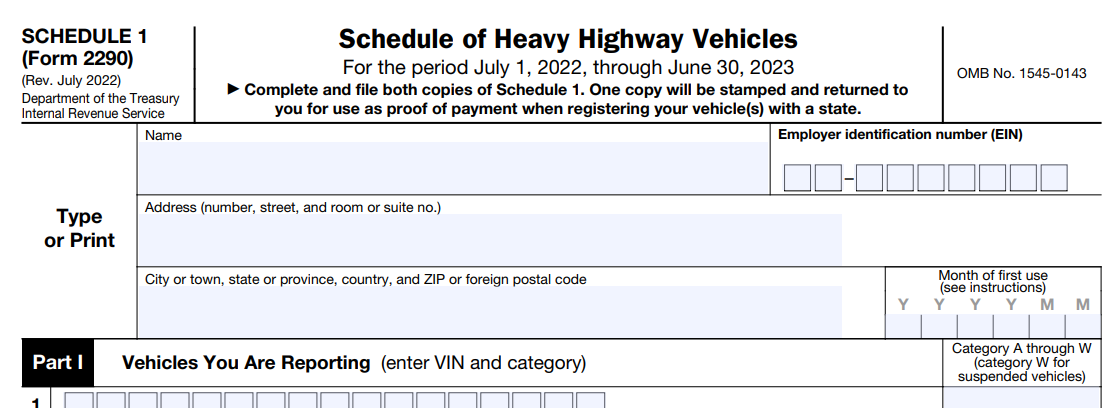

IRS Form 2290 Heavy Highway Vehicle Use Tax Return, Form 2290 Rev July 2022 Heavy Highway Vehicle Use Tax Return Department of the Treasury Internal Revenue Service 99 For the period July 1 2022 through June 30 2023. Printable Form 2290 simple truck tax, Unlike Free Printable 2290 Form forms fillable forms individuals can fill in details directly on the electronic paper Creating them is similar to forms but requires some added steps After making the form design you have to add interactive areas where users can input their information Save the record in a fillable layout such as PDF .

Free Printable 2290 Form

Printable Form 2290 simple truck tax

Form 2290 serves as the Heavy Highway Vehicle Use Tax Return for the tax period from July 1 2017 to June 30 2018 This form is essential for reporting heavy highway vehicle usage and calculating corresponding taxes Edit Download and Share this printable form document or template now Get IRS Form 2290 Form PrintFriendly makes web .

Free Printable 2290 Form Printable Forms Free Online

Form 2290 Rev July 2022 Heavy Highway Vehicle Use Tax Return Department of the Treasury Internal Revenue Service 99 For the period July 1 2022 through June 30 2023.

span class result type PDF span Form 2290 Rev July 2022 Internal Revenue Service

Unlike Free Printable 2290 Form forms fillable forms individuals can fill in details directly on the electronic paper Creating them is similar to forms but requires some added steps After making the form design you have to add interactive areas where users can input their information Save the record in a fillable layout such as PDF .

Instructions for Form 2290 07 2024 Internal Revenue Service

Get IRS Form 2290 printable fillable versions Complete the 2290 tax form online or print it out to fill in manually Check out the latest instructions examples File HVUT error free with our checklists tips Here you can find everything about the printable 2290 form for 2022 and 2023.

IRS Form 2290 Heavy Highway Vehicle Use Tax Return

Search for Form 2290 Use search function on site to find form number 2290 Download PDF Click on appropriate link which lets you get this form as PDF file Print the Form Open a downloaded PDF and print it using common printer Completing the Printable Form 2290 The process of filling out Form 2290 must be accurate Below is a step by step .

IRS Form 2290 Heavy Highway Vehicle Use Tax Return TemplateRoller

The current period begins July 1 2024 and ends June 30 2025 Form 2290 must be filed by the last day of the month following the month of first use as shown in the chart later Enter your name and address exactly as shown on Form 2290 Print your name clearly Schedule 1 Form 2290 the IRS offers Free File Fillable Forms which .

Disclaimer: All printables provided on this website are for personal use only. We do not claim ownership of the content unless explicitly stated. If you encounter any issues with copyright or usage, please contact us for removal or clarification.

FAQs

1. What are free printables?

Free printables are digital files available for download at no cost, such as educational worksheets and more.

2. What can I find on the site?

We offer a wide range of printables, including learning sheets, coloring sheets, and more for children.

3. What’s the download process?

To download a printable, just click on the image or link, and it will open. Right-click to save it to your device.

4. Are the printables of good quality?

We provide high-resolution files that are perfect for printing in formats like PNG and JPG.

5. Can I use the printables for business?

These printables are free for personal use. Please refer to the original creator’s terms for commercial use.